The IRS has announced updates to contribution limits for the new year to help individuals better save for retirement. There have been increases to the 401(k), 403(b), 457(b), IRA, and catch-up contribution limits, along with changes made in SECURE 2.0 declaring that a higher catch-up contribution limit applies for employees aged 60, 61, 62, and 63 who participate in these plans.

Additionally, the requirement for higher earners to make catch-up contributions as mandatory Roth contributions takes effect on January 1, 2026. This regulation applies to those with FICA wages of $150,000 and above during 2025.

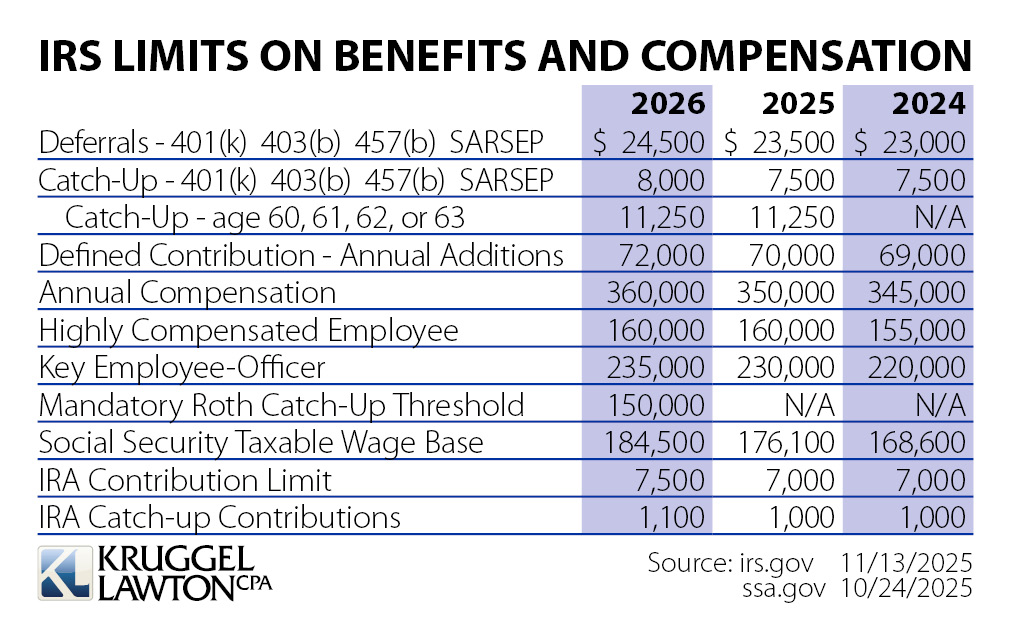

Below is a comparison chart showing limits for 2026, 2025, and 2024. If you have questions on how the new limits may impact you, please reach out to your Kruggel Lawton advisor.